Unlock Up to $8,400 in Federal solarprogramhub — Discover Your Zip‑Code Eligibility Today!

Are you ready to slash your electric bills—and potentially send them to zero? The U.S. Federal Residential Renewable Energy Tax Credit now empowers homeowners like you to:

- Enjoy $0 upfront installation costs with qualified local solar providers.

- Claim tax credits and rebates up to $8,400 for switching to clean energy.

- Bring monthly energy costs down to near‑zero, thanks to solar-generated power.

- Enhance your home’s value and efficiency, while shrinking your carbon footprint.

Why This Isn’t Your Typical “Sales Pitch”

- Government-backed benefit — This isn’t a gimmick. It’s a legitimate federal incentive designed to accelerate clean-energy adoption.

- No surprise fees — Zero upfront investment means no financial surprises—just clear, transparent benefits.

- Designed for your neighborhood — Your qualification depends on your zip code, and checking is completely free with no obligation.

- Trusted solar professionals — We partner only with vetted, top-rated installers who compete to give you the best quote and service.

How to Get Started (Takes Less Than 60 Seconds)

Check Your Eligibility

Enter your zip code—our system instantly shows the latest federal credits and rebate packages available to you.

Review Installer Quotes

Receive competitive bids from reputable local solar firms, customized for your home and incentives.

Activate Savings

Move forward with $0 upfront cost, apply your tax credits, and watch your energy bills shrink—or disappear entirely.

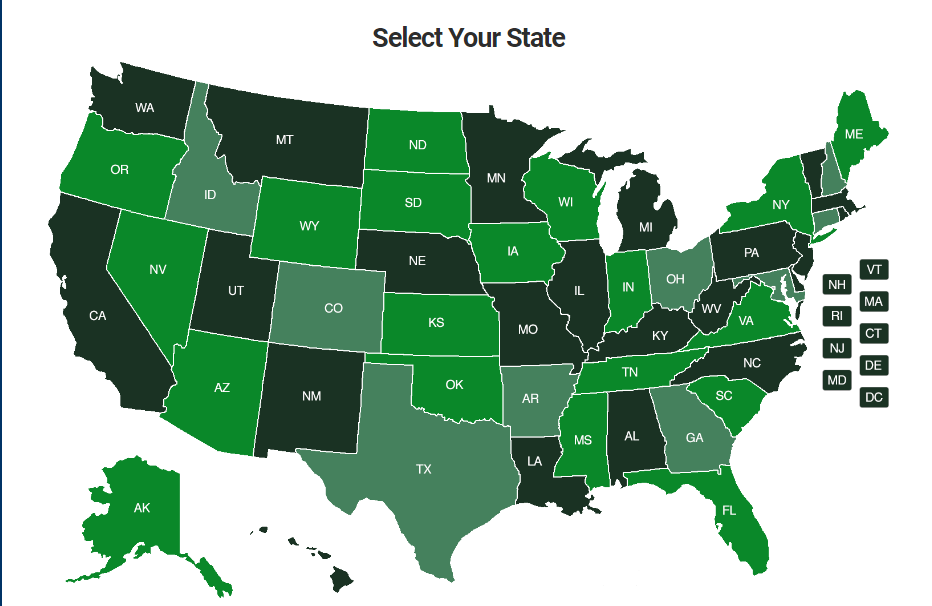

See If Your Area Qualifies

This federal program is available in specific zip codes across the nation. Check your eligibility to see the exact incentives available for your home.

Don’t Delay—Federal Incentives Expire Soon

These grant programs are temporary. Act now to lock in a potential $8,400 benefit—and years of energy savings. Even utility providers don’t want you to know how fast a home can become self‑sufficient on solar power.

Check eligibility now to take advantage before deadlines hit.